Bitcoin plummeted to below 61,000 dollars on Thursday and erased months of hopeful betting in the process. Solana crashed to 81 dollars and cleared out tens of thousands of individual accounts across Europe and farther out.

The specific amounts recount a recurring cycle of ruin where the latest downturn replicates the wreckage of 2018 and 2022. Every new start promised by the market eventually left late arrivals in financial wreckage.

The smartphone revolution democratised crypto markets with a level of accessibility unknown in traditional finance because a person with a mobile device can now buy digital coins in minutes. Amateur investors now move past the historical hurdles that used to protect them from making impulsive choices.

The Smartphone Slot Machine

User-friendly platforms and clean designs made it easy for more people to explore digital assets. If a person downloads an app and links a bank account to buy Bitcoin, the frictionless entry arrives at the expense of actual investor safety.

Traditional brokers must follow regulators by keeping enough money on hand and keeping customer cash separate from their own business funds.

Crypto buyers operate in a region that lacks standard safety nets like insurance or established methods to settle grievances.

The head of Robinhood admitted that running a crypto business costs a tenth of what a stock trading platform costs.

The low overhead that drives exchange profits leaves the average person without a safety net and creates a gambling floor where the house can alter the odds at any second.

Access Acting as Exposure

About 21 percent of Americans who owned cryptocurrency reported that their holdings vanished into total losses. The data point deserves attention because one in five people lost money as they reached for growth that never arrived.

Deceptively simple apps masked a puzzle of risks that many investors were not prepared to judge.

Research points toward the fact that 97 percent of day traders who stayed active for more than 300 days ended up with nothing to show for their effort. Rapid trading rarely yields steady returns and crypto trading intensifies the ruin with markets that never close and extreme price swings.

Using borrowed money can multiply losses far faster than any possible gains.

Trading in prediction markets acts essentially as high-stakes betting. The same logic applies to most crypto speculation because people who bought Solana at 140 dollars and sold it at 88 dollars were placing wagers despite the professional image around the activity.

The Missing Guardrails

Stock markets grew over many decades with rules to protect everyday investors from large risks. There are emergency stops that halt trading during a crash and limits on how much money a person can borrow to trade. Disclosure rules also force organisations to be honest about their financial health before they sell shares.

Crypto markets operate with a total absence of supervision. Dishonest actors take advantage of investors through various schemes and market abuse and the use of aliases in transactions creates a level of anonymity that makes getting money back nearly impossible.

None of the major crypto companies registered with the Securities and Exchange Commission as brokers or exchanges.

The lack of registration means investors are left without any of the protections that have existed for decades and if crypto platforms fold users find out their deposits were entirely uninsured.

What Remains After the Fall

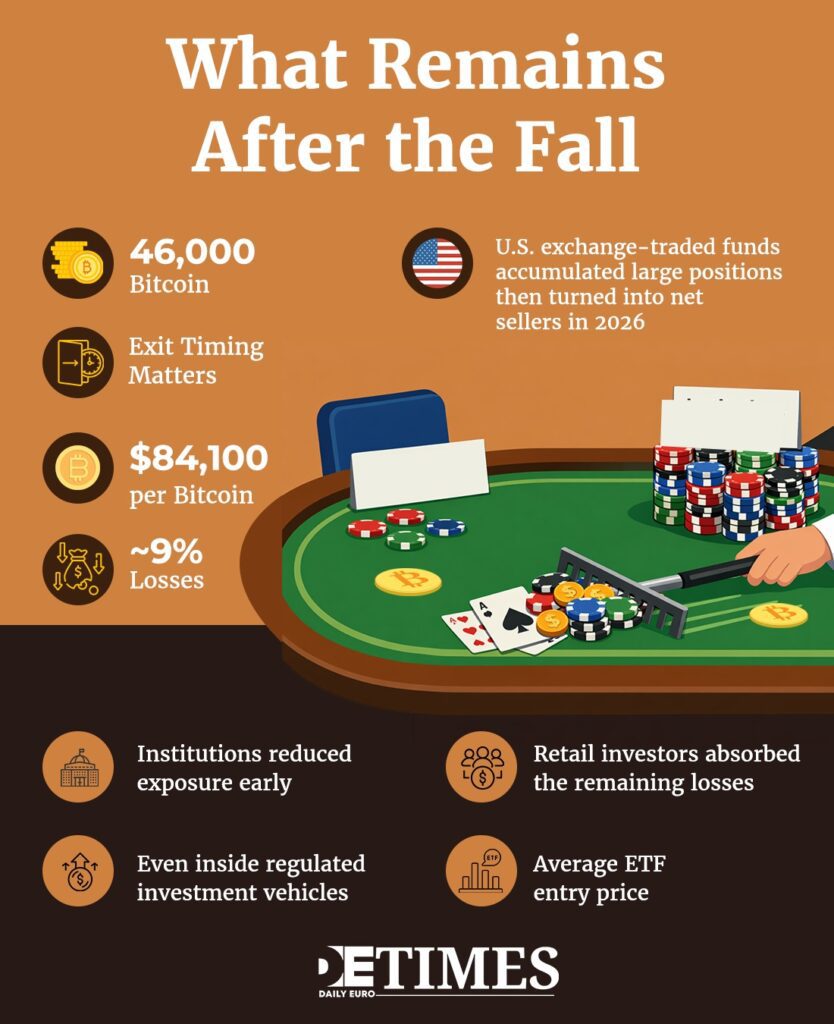

Exchange-traded funds in the United States purchased 46,000 Bitcoin at the same point last year but they turned into net sellers in 2026. Big funds pulled out and left everyday people to carry the weight of the losses.

The cycle repeats during every crypto winter as the smart players leave early and individual investors hold on for a recovery that stays out of reach.

Buyers who entered through exchange-traded funds paid an average of roughly 84,100 dollars per Bitcoin and they are now sitting on losses of nearly nine percent. Even in a regulated investment vehicle the losses are heavy. The damage is even more severe for people who bought directly from exchanges that offer no protection at all.

The reality of digital assets becomes obvious during a crisis. Gold gained value as Bitcoin dropped and stocks recovered as crypto lost value. The supposed safety of crypto turned out to be a speculative bubble.

Rethinking Digital Finance

The movement to open finance ended up spreading the risk to everyone and kept the gains among a few winners. The technology may be useful for certain tasks but the current market mostly serves to transfer wealth to professional traders and platform owners.

European regulators deserve credit for starting a new framework for crypto assets that sets common rules. The belated protections arrived too late for many who bought during the last rush but they may stop future disasters.

About 59 percent of Americans do not trust the security of cryptocurrency and 16 percent of owners have had problems getting into their accounts. One in six users dealt with issues like frozen accounts or exchange outages and the technical hurdles only add to the financial losses.

The way ahead requires a shift toward stronger regulation or more blunt warnings that the activity is only speculation comparable to casino betting. The current confusion only helps the platforms that profit from fees and avoid all responsibility for customer losses.

Until regulators force the same organisations to follow the standards that govern the stock market every download of a trading app is a risk and a gateway to financial harm that has been presented as innovation.

Keep up with Daily Euro Times for more updates!

Read also:

West Hunts Russian Crypto Laundering as Networks Shift to Kyrgyzstan

Bybit Afloat: Dubai Crypto Firm Survives Despite Historic Hack

Crypto Gamble Chains Milei’s Presidency to the Fence