Amsterdam introduced a 30-night yearly limit on short-term rentals in 2019. By 2024, Airbnb listings fell by 54 percent. Despite a large drop in rentals available, rents of housing still rose.

Barcelona enacted a pause on tourist accommodation licenses in 2014. A decade later, rents had increased by 70 percent. This shows limiting short-term rentals fails to stop rent inflation.

The housing shortage worsens every year. Politicians respond by tightening rules on short-term rentals. Hotels take their place.

The Hotel Lobby Wins

Across Spain, local governments have approved plans to build over 800 new hotels. Barcelona’s mayor claims that ending short-term rentals will create 5,000 new hotel rooms. This signals a shift in focus from alternative accommodations to traditional hotels.

In 2023, three quarters of Barcelona’s tourists stayed in hotels and hostels. That confirms hotels already dominate tourist lodging. In the Old Town, tourism impacts residents the most, with hotel beds outnumbering short-term rental beds by a ratio of six to one. Hotel stays in Barcelona surged 60 percent since 2014, making hotels far more common than short-term rentals.

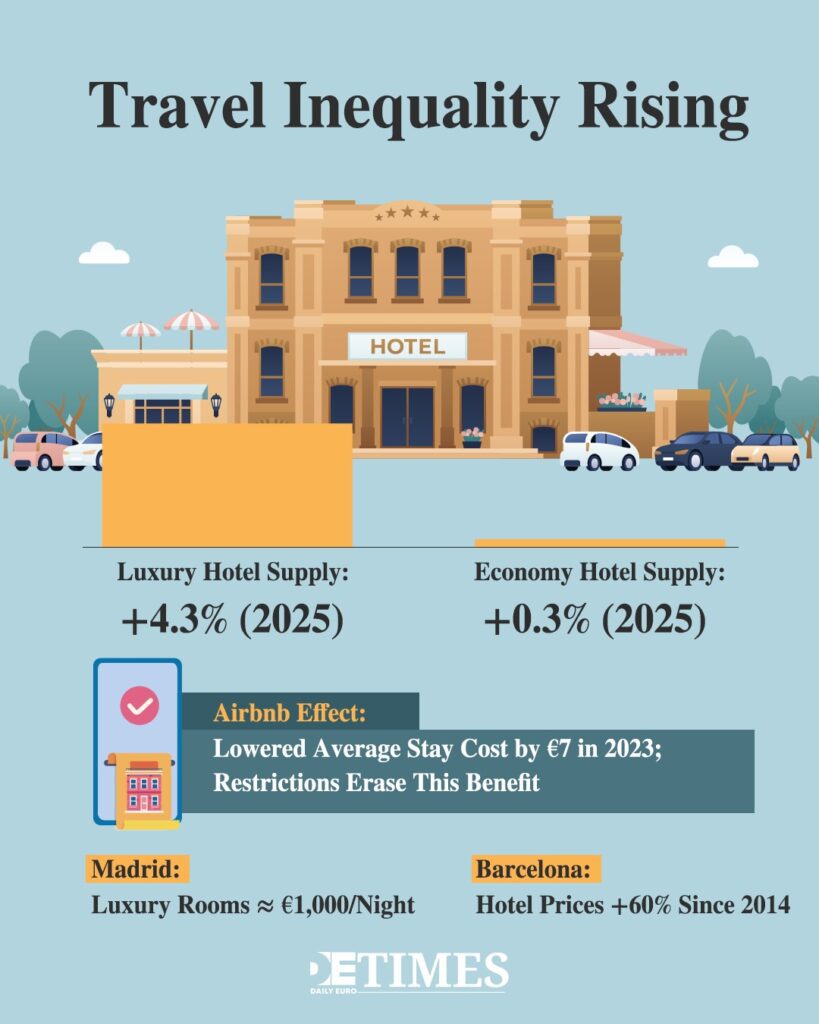

International hotel chains now set prices. The average hotel room in Barcelona rose over 60 percent in cost during the past decade. Luxury hotels in Madrid charge about one thousand euros per night. Wealthy visitors from Asia and the Middle East afford these rates, but families on a budget from Europe cannot. This creates an exclusivity barrier in accommodation.

Profits shifted as Amsterdam lost 269 million euros in host earnings after these regulations came in. That money flowed to big hotel chains instead, showing a financial transfer upwards.

Pricing Out Working Families

Platforms like Airbnb lowered the average overnight stay cost by seven euros in major EU cities during 2023. This reduction made travel affordable for many visitors. When restrictions come in, the downward price effect disappears, making travel costlier.

European luxury hotel supply grew by 4.3 percent in 2025, while economy hotels increased by only 0.3 percent. Investor focus remains on high-end hotels where wealthy tourists pay top prices, rather than affordable lodging.

Travel risks turning into a privilege only for the richest as short-term rentals become less available. Milan welcomed 300,000 foreign-born residents in 2023. Professionals earning premium salaries fill expensive hotels and long-term rentals, pushing out locals who cannot afford such costs.

Regulations exclude modest-income tourists from the market. Five-star hotels cater only to those able to spend more. France overtook Italy in luxury travel bookings in 2025. Working families from other parts of Europe lose access to affordable travel options.

The Housing Supply That No One Builds

Short-term rentals make up under 0.5 percent of the total housing in Lisbon, Barcelona, Madrid, Paris, Berlin, and Amsterdam.

This represents a very small fraction of the housing market. Listings with high occupancy are even fewer, under 0.09 percent in Amsterdam and 0.94 percent in Barcelona. This scale shows short-term rentals cannot be the main cause of housing shortages.

Spain has built fewer homes since 2014 than during any period since 1970. New households grow three times faster than new home construction, as shown in 2023. Meanwhile, Barcelona has eight times more vacant homes than short-term rentals, pointing to housing availability issues beyond rental regulations.

The continuing shortage of new construction concerns many. Von der Leyen pointed out a 20 percent drop in building permits over five years. Government efforts focus more on blaming rental platforms rather than funding housing. Passing rules costs less than investing in new buildings.

Revenue Flows Upwards

Short-term rental guests created 149 billion euros of economic value across EU countries in 2023. Over 55 percent of stays took place outside major cities, expanding impact beyond crowded urban centres.

Domestic travelers and families benefit from affordable options. In 2023, 67 percent of stays involved Europeans, with nearly 40 percent of bookings including families with children. These groups depend on flexible, cost-effective accommodations.

Hotel chains capture most of this revenue. Shareholders benefit, while local hosts lose extra income. Almost half of European hosts say supplementary earnings help cover rising living costs. Regulations remove this financial support, making life harder for many working families.

Tourism increasingly splits by income class. Luxury hotels serve wealthy internationals, budget hotels serve package tours, and middle-income independent travelers vanish.

Who Actually Gains

Spain ordered removal of over 65,000 Airbnb listings in May 2025. Spain’s Constitutional Court upheld Barcelona’s ban in March 2025. Strong action from officials failed to lower housing costs.

EU lawmaker Dan Jørgensen labeled short-term rentals as a major problem. However, evidence indicates that housing crises stem from construction shortages, wealthy buyers outbidding locals, and foreign professionals earning higher salaries.

Building more homes, curbing speculation, and raising local wages are necessary fixes. Governments choose to target platforms instead. Difficult reforms get avoided. Large hotel chains grow stronger, and wealthy travelers continue coming.

Keep up with Daily Euro Times for more updates!

Read also:

Spain: Adiós Relaxation, Hello Red Tape

Tourists Under Fire: Europe’s North-South Economic Divide

Milan’s Expat Boom: Are They Bringing Their ‘Best’?