Hungary has actively grown its reliance on Russian crude oil. What was 61 percent before Russia’s attack on Ukraine climbed to 86 percent in 2024.

So far in 2025, a staggering 92 percent of Hungary’s crude imports trace back to Moscow.

The figures point to deliberate economic choices.

Washington Turns Off the Tap

Now, Washington is turning the screws. President Donald Trump imposed sweeping sanctions against Russian oil giants Lukoil and Rosneft. The restrictions pushed up oil prices, creating headaches for Hungary and Slovakia.

Even so, by May, crude oil purchases from those two countries had sent 5.4 billion euros to the Kremlin.

Budapest isn’t complying quietly. Prime Minister Viktor Orban announced his government is actively working to get around the new US sanctions.

Foreign Minister Péter Szijjártó said the government is "examining the possible effect," phrasing that sounds very much like bureaucratic foot-dragging.

The Obvious Croatian Option

The strange part is that an option already exists.

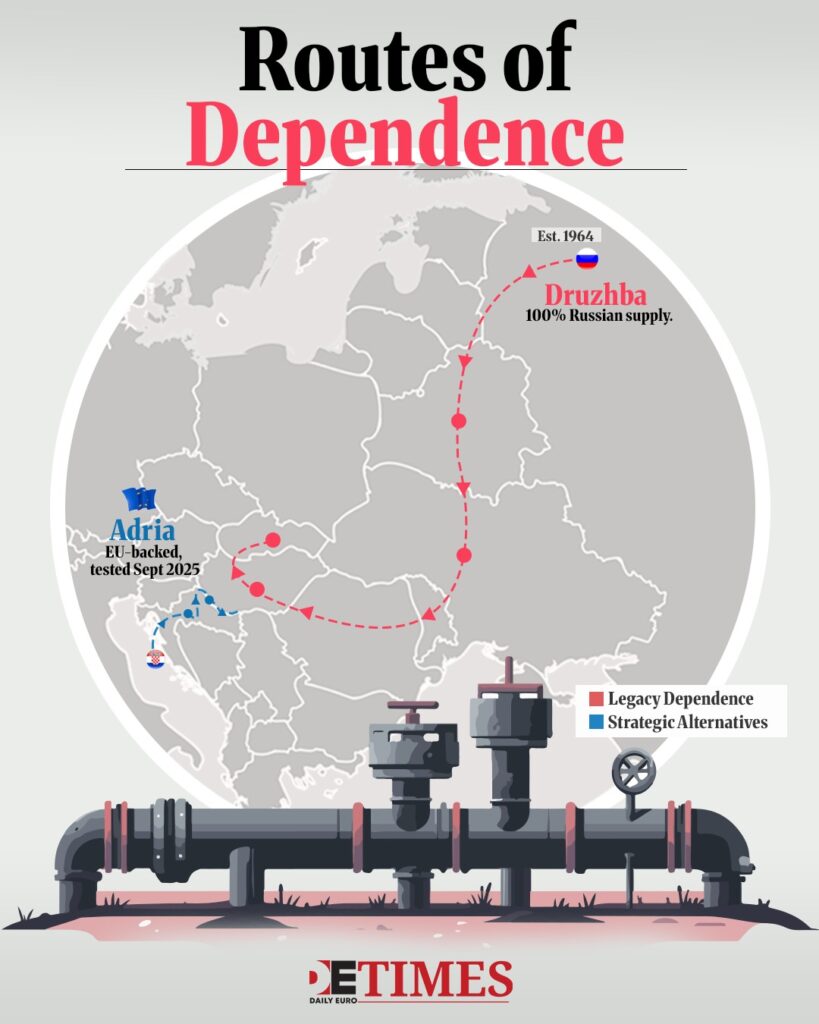

A report from the Centre for the Study of Democracy and Centre for Research on Energy and Clean Air noted that Hungary could get non-Russian oil through Croatia's Adria pipeline.

The Adria pipeline has a total capacity of 14.3 million tonnes per year; the Hungarian section alone can handle 10 million tonnes.

Currently, Croatia buys 2 million tonnes, Serbia 3.3 million, and Hungary’s own MOL has a contract for 2.2 million (by the end of 2024). That leaves 6.8 million tonnes of unused capacity.

What’s more, Croatian Prime Minister Andrej Plenkovic said the pipeline’s capacity could be boosted by 30 percent in only 20 to 30 days, requiring an investment of only 8 million euros.

Hungary’s MOL even secured contracts for non-Russian oil via Adria: 2.2 million tonnes in 2023 and 2.1 million tonnes for 2025.

Tellingly, deliveries in 2023 didn’t even reach half of the contracted amount.

The Fight Over Fees

So why the hesitation? Budapest’s main public complaint is cost.

Foreign Minister Szijjártó accused Croatia of “profiteering” from the war. He claims that since the war began, Croatia has repeatedly raised transit fees to a level five times higher than the market average.

The Croatian pipeline operator, Janaf, maintains its prices are set by negotiation, using a private methodology based on pipeline length and use.

Still, the fees should logically be good for Hungary. The pipeline from the Croatian terminal to the Hungarian border is only 289 kilometers long.

MOL Wants to Buy In

If the fee dispute wasn’t enough, MOL unexpectedly announced it wants to buy a stake in Janaf, the Croatian operator. MOL stated the action follows a “Western European model” where users co-own infrastructure, supposedly ensuring fairer prices and reliable supply.

Croatia’s response was blunt. Prime Minister Plenković stated Janaf is not for sale and the government won’t change its ownership structure.

The proposal seems related to MOL’s existing 49.08 percent ownership of INA, Croatia’s main energy company, where the Croatian government holds 44.84 percent.

Disputed Technical Tests

Budapest has also raised technical doubts. MOL claimed that tests failed to show the pipeline can deliver enough crude oil to Hungary and Slovakia over the long term. They alleged the pipeline couldn’t operate at the needed capacity for more than one or two hours at a time.

Janaf’s management disputes that assessment, stating the system is capable of transporting up to 14.7 million tonnes of crude oil per year, theoretically enough to cover both countries.

Furthermore, previous experience confirms MOL’s refineries can process non-Russian crude. During a contamination crisis in 2019, Hungary’s use of Russian oil temporarily fell to 48 percent as it successfully used oil supplied via the Adria pipeline.

Pressure Mounts as Excuses Wear Thin

Allies are losing patience.

U.S. Ambassador to NATO Matthew Whitaker told Fox News that Hungary, unlike its neighbours, "has not made any plans and has not taken any active steps." Whitaker said the United States expects Hungary to devise a plan to stop Russian oil imports.

That fits the EU’s goal of phasing out Russian energy by 2027. Member states are required to submit their diversification plans by the end of 2025.

The numbers make Budapest’s explanations difficult to accept. Oil dependence has jumped to 92 percent. Zagreb offered a quick capacity expansion for only 8 million euros. Still, Budapest persists in buying from Moscow, claiming Zagreb’s fees make other options unworkable.

Orban told Trump that without Russian energy, Hungary’s economy “would be brought to its knees.” That claim seems hollow as surplus pipeline capacity sits unused right across the border. All the while, MOL profits from discounted Russian crude, and Hungarian consumers must pay prices above EU averages.

The months spent arguing over transit fees and technical tests look like a calculated delay.

Keep up with Daily Euro Times for more updates!

Read also:

Europe Boards Russia’s Ships: New Rules for Sea Conflict

Hungary and Slovakia: EU Veto as a Double Edged Sword

One Against Twenty-Six: Hungary’s Tariff Gamble