The EuroHPC Joint Undertaking selected six new AI factory locations this October, including sites in Czechia, Lithuania, the Netherlands, Poland, Romania, and Spain. That brings the total number of facilities to 19 across 16 EU member states.

Investment Figures Show Contrasting Perspectives

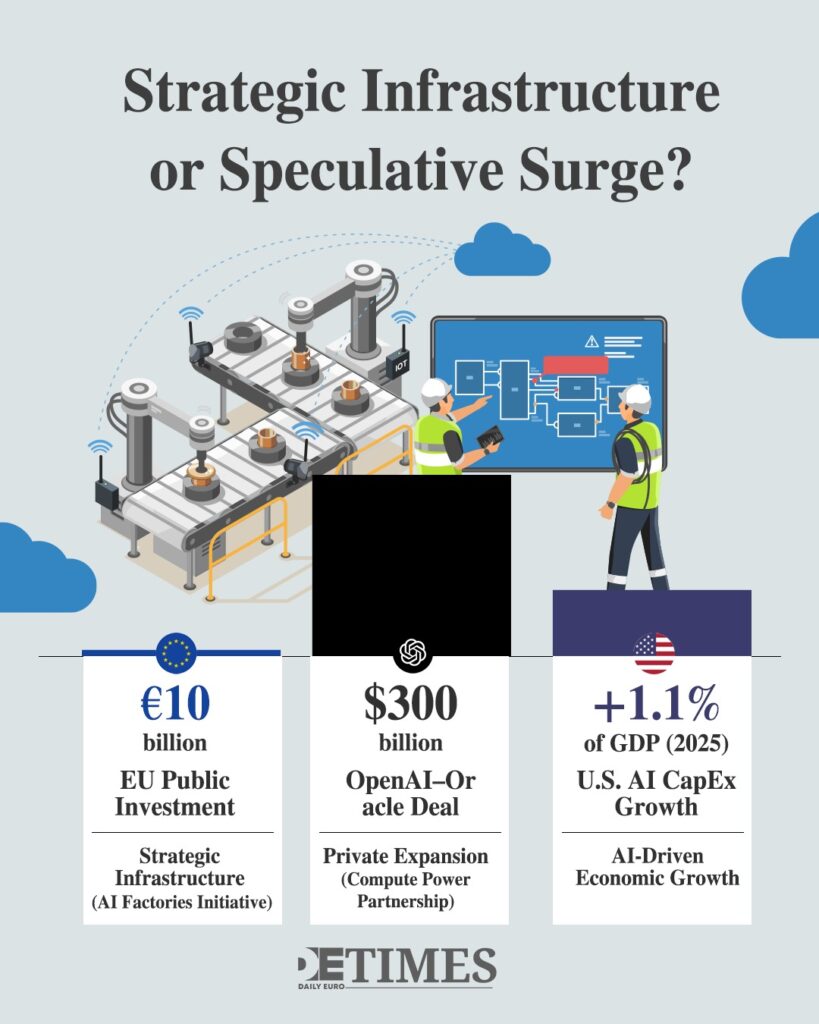

In February, Commission President Ursula von der Leyen launched the InvestAI initiative during the AI Action Summit in Paris, aiming to mobilise €200 billion for AI investments. The EU and member states have committed €10 billion specifically for AI factories, representing the largest public investment worldwide in this field.

Von der Leyen expects that this public funding will unlock ten times more money from private investors.

By July, the bloc had received 76 expressions of interest for these gigafactories, indicating strong demand among companies for advanced computational resources.

At least 15 AI factories and related facilities will be operational by 2025-2026, focusing on giving AI startups and smaller companies better access.

Industry Leaders Express Concern

Despite these developments, questions arise about the current expansion pace. Sam Altman, CEO of OpenAI, warned that many will overinvest and lose money in this growth phase, even though OpenAI itself is central to billions in infrastructure deals.

Goldman Sachs CEO David Solomon described the environment as an industrial bubble, and Jeff Bezos shared similar views in early October.

Meanwhile, tech giants are investing unprecedented sums into data centers while AI firms achieve valuations in the hundreds of billions. OpenAI reached a valuation of US$500 billion despite ongoing losses.

Europe’s Different Approach

The EU’s AI factories serve a distinct purpose compared to private initiatives. They are designed to strengthen Europe’s strategic autonomy and support startups, industry, and academia within European borders, as detailed here.

These facilities reduce AI training costs and speed for European businesses, particularly smaller companies at a competitive disadvantage compared to American and Chinese firms controlling massive computational power.

Rather than following the investment cycles of private actors such as OpenAI’s $300 billion computing power deal with Oracle, Europe emphasizes long-term strategic benefit.

Oracle itself anticipates financial losses from renting data centers mostly to OpenAI, reporting a $100 million loss in a recent quarter.

Economic Impact and Returns

AI-related capital expenditures exceeded consumer spending as the main driver of U.S. economic growth in early 2025, contributing 1.1% of GDP growth.

However, an MIT study showed that 95% of 52 organizations studied reported no return on $30-$40 billion spent on generative AI projects. The study evaluated over 300 efforts.

At a Yale CEO Summit, 40% expressed concern about excess spending and expected a market adjustment, while 60% saw no immediate risk.

European AI factories operate with public oversight and well-defined goals for both academic and commercial use. Private ventures aim for profit and may face greater financial risks. This distinction remains crucial.

Risks in Building Capacity

Bethany McLean recalled the overbuilding of fiber-optic infrastructure during the 1990s dot-com bubble which resulted in unused capacity for years due to rapid technological advances.

Similarly, improvements in semiconductor design or quantum computing could soon make current data centers outdated. Excess computing resources may remain underused for years, exposing investors to financial risk.

Europe pursues AI infrastructure for strategic independence rather than short-term profit, having learned lessons from energy dependency.

Computing power now stands as a vital strategic asset, and maintaining AI capabilities in Europe avoids complete dependence on American or Asian providers.

Charles Mackay noted that crowds “go mad in herds” but regain sense slowly. This observation fits every technology expansion including AI development.

The key question is whether Europe’s measured, publicly guided investments will prove wiser than the private sector’s rapid funding.

These six new AI factories will either become critical infrastructure supporting Europe’s competitive stance or costly endeavors driven by enthusiasm. Only the future will clarify which path prevails.

Keep up with Daily Euro Times for more updates!

Read also:

K2 to the Rescue: AI Model Outsmarts France’s Mistral

AI Startup Breakthrough: France and UAE Talk the Talk with Le Chat

How to Kill Corruption? AI Of Course