According to the latest survey by the European Consumer Organisation, the vast majority of Europeans expect the upcoming digital euro to be secure, convenient, and free. The study, conducted among more than 10,000 consumers from 10 eurozone countries, revealed citizens’ key preferences regarding the future digital currency.

Consumer Expectations:

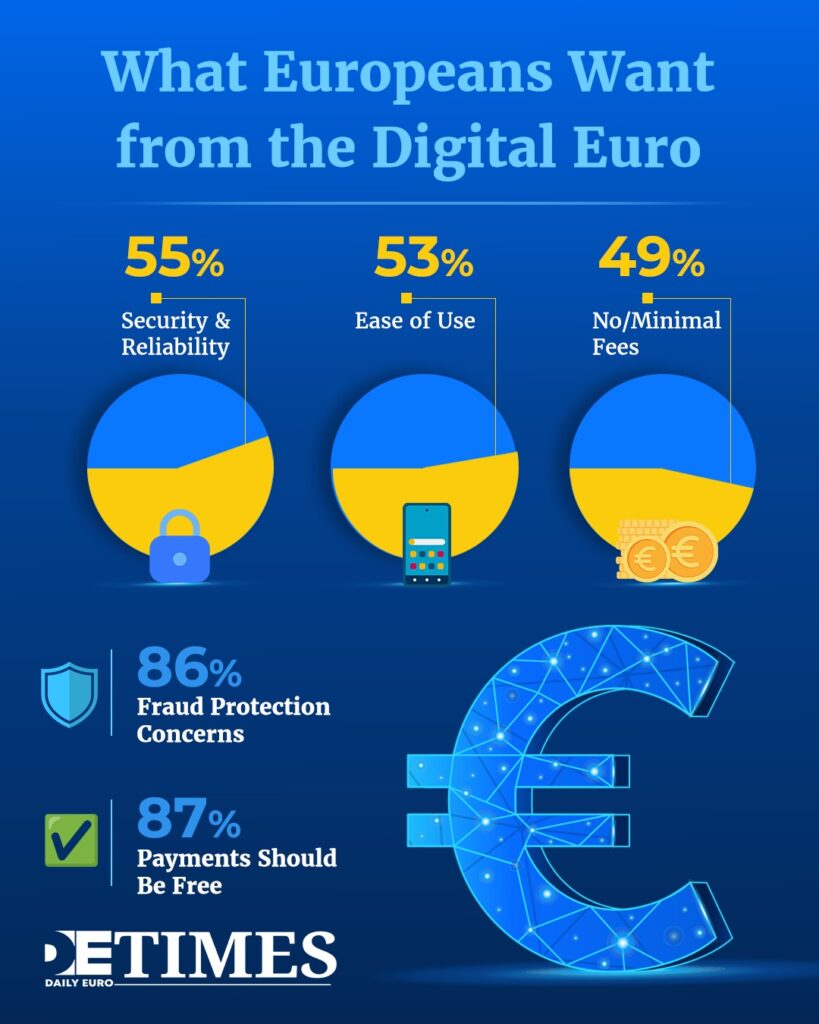

Respondents noted that the most important characteristics of a digital euro should be:

Security and Reliability – 55% of respondents;

Ease of Use – 53%;

No or Minimal Fees – 49%.

Additionally, 86% of participants expressed concerns about fraud protection whilst 87% believed that digital payments should be free.

Digital Currencies in Gulf Cooperation Council: User Rights Vs Geopolitics

While Europe is striving to create a digital euro, GCC countries are actively developing their own digital currencies.

For example, the United Arab Emirates is preparing to launch a digital dirham, which will be backed by the UAE Central Bank and will offer a high degree of security and efficiency.

However, unlike Europe, which emphasises consumer protection and transparency, the GCC countries are focused on strengthening financial independence and reducing dependence on the U.S. dollar. This reflects differences in strategic objectives: Europe focuses on consumer interests, while the GCC countries seek to strengthen their financial autonomy in the global economy.

Prospects for a Digital Euro

The Banque de France and the European Central Bank are actively working on the legislative framework for the implementation of a digital euro.

A political agreement is expected by early 2026, and the digital currency could be launched in 2029.

The ECB plans to conduct pilot programs in selected eurozone countries to test its usability and security features before full-scale implementation. Experts predict that widespread implementation could significantly reduce transaction costs and improve the efficiency of both retail and cross-border payments.

Furthermore, the digital euro is expected to exist alongside cash, providing citizens with access to traditional payment methods.

Privacy and Data Protection in the Digital Euro

The European Central Bank is developing a digital euro with a focus on maximizing the protection of users’ personal data.

According to the ECB's official position, the digital euro will provide a high level of privacy by not linking users to their transactions and preventing direct tracking of their payments. The ECB also guarantees that user data will not be used for commercial purposes.

While some countries in the region are also taking data protection measures, GCC approaches to privacy may differ from European standards particularly on user rights and transparency.

European consumers’ needs for a digital euro underscore the importance of creating a secure, convenient, and free digital currency for all Europeans.

Read the Latest Articles on DET!

Suez on Rails: China is Changing the Map

Plucked Out of Thin Air? How Meteorologists Name Storms

I Need My Labubu: Wang Ning’s Billion Dollar Toy