Next season, six Premier League teams will compete in the Champions League.

The feat is the culmination of immense, strategically applied financial power and a league structure that sustains relentless competition.

How a financial juggernaut, supercharged by Gulf capital, altered the competitive order of European football?

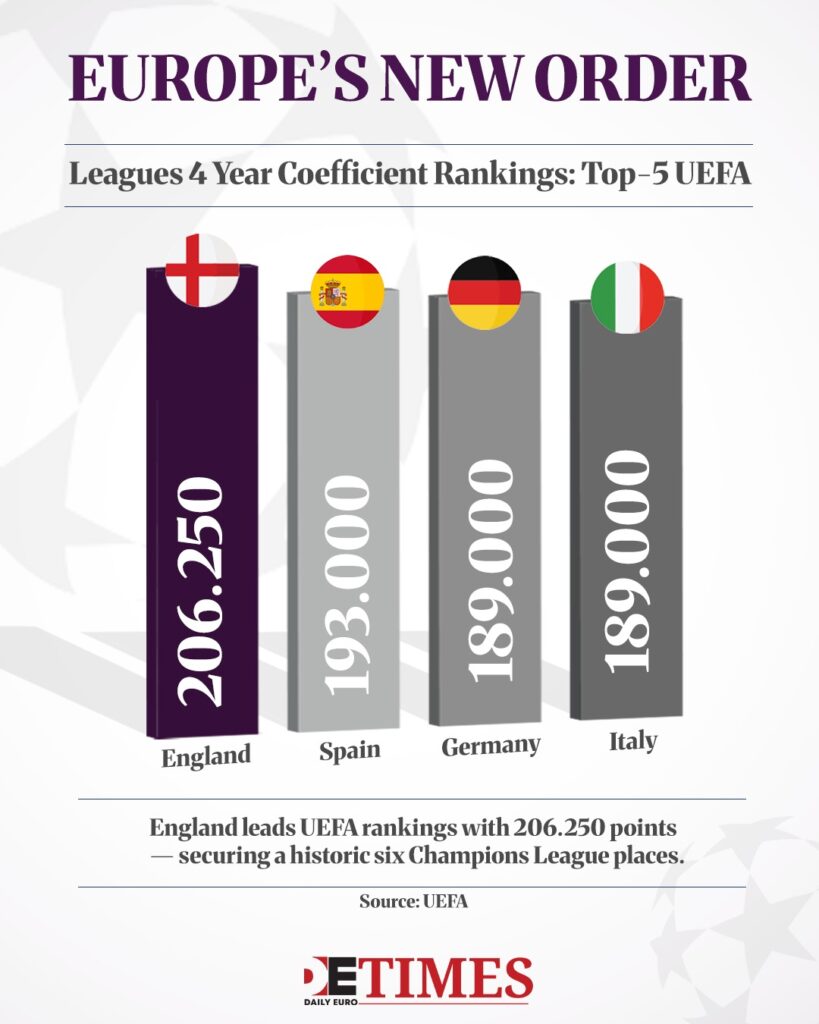

The achievement was built on strong performances across the board. England secured the extra spots after topping the UEFA coefficient rankings.

Liverpool clinched the title under new manager Arne Slot, while Arsenal, Manchester City, Newcastle, and Chelsea also earned their places through league standings.

Tottenham added the sixth spot by winning the Europa League, a testament to the league’s strength in multiple competitions.

The Financial Bedrock of the Premier League

The foundation of English football’s preeminence is its staggering financial muscle.

In 2023, Premier League clubs generated revenues over €7.1 billion, creating a financial reality unmatched across Europe.

Such wealth is driven by enormous media and commercial deals. Upcoming broadcast rights for 2025 to 2028 reached a massive £12.25 billion, while commercial revenue secured €2.2 billion.

A central feature is how the money is distributed to provide financial security throughout the entire league. In 2024/25, each club received a base payment of £96.9 million.

The model provides that clubs are well-resourced to compete. Southampton collected over £100 million before being relegated, giving the club a strong chance to bounce back.

The Game Changers: Gulf Investment Alters Fortunes

The league was already wealthy, but targeted investment from the Gulf acted as a powerful catalyst.

The evolution of Manchester City, which began with its 2008 purchase by the Abu Dhabi United Group, serves as the ultimate blueprint.

The club went on to win five of the last six league titles before the 2024/25 season through an all-encompassing investment strategy, building world-class infrastructure and a productive academy. The sustainable method saw City report record revenues of £715 million in 2023/24.

More recently, Newcastle United has followed a similar course. Since a Saudi-backed consortium completed its takeover in 2021, the club’s fortunes have soared.

Revenue increased by 28% to £320.3 million. With substantial cash injections from the Public Investment Fund, losses were decisively curtailed to £11.1 million, achieving a rapid financial turnaround.

How Money Translates to European Performance

Such immense financial power directly translates into on-field dominance. English clubs can afford to assemble incredibly talented squads.

By 2024, Chelsea’s squad cost €1.66 billion to build, while Manchester City, Manchester United, and Arsenal all boasted squads worth over €1 billion. It is no surprise that nine English clubs ranked in Europe’s top 20 for wage spending.

The league-wide quality drives up the UEFA coefficient. The system rewards collective performance, giving two points for a win and one for a draw. Five Premier League teams progressed to the Champions League quarter-finals in 2024/25, setting a new European benchmark.

With all seven English teams in Europe contributing points, England topped the rankings with 206.250 points.

The competitive breadth was also on display domestically, where Newcastle won its first trophy in 56 years and Crystal Palace stunned Manchester City to claim their first major honor in 119 years.

Playing by the Rules: A Framework for Sustainable Growth

The formidable spending operates within a strong regulatory framework that encourages sustainability. Player wages have settled at a sustainable average of 49% of club revenue.

Profit and Sustainability Rules (PSR) limit losses over a three-year period, forcing clubs to be smart. To comply, clubs have turned their youth academies into profit centers. Newcastle neared its limit in 2023/24 but balanced the books by selling homegrown talent for over £70 million.

Chelsea has mastered this strategy, funding its expensive squad by selling academy graduates for hundreds of millions in pure profit. Gulf investors have adapted, channeling their resources into long-term growth through infrastructure and commercial partnerships.

A Self-Sustaining Cycle of Global Dominance

The combination of factors has established a powerful, self-perpetuating cycle. The Premier League’s global appeal drives ever-larger broadcast deals, with international markets showing particular growth in the latest cycle.

The money allows clubs to sign the world’s best players, who in turn deliver victories in Europe. Victories in turn boost the league’s brand, attracting more fans, sponsors, and even greater investment.

The financial gap between the Premier League and its continental rivals is widening every year. The English league has perfected a winning formula that pairs its vast resources with strategic excellence.

The six Champions League spots are the ultimate validation of the model, proof that English football’s era of European dominance is well and truly here.

Keep up with Daily Euro Times for more updates!

Read also:

Akram Afif: Fair Play Needed On and Off the Pitch

European Stadiums: A New Theatre in the Congo War

On-and-Off the Pitch: Saudi Investment in Newcastle