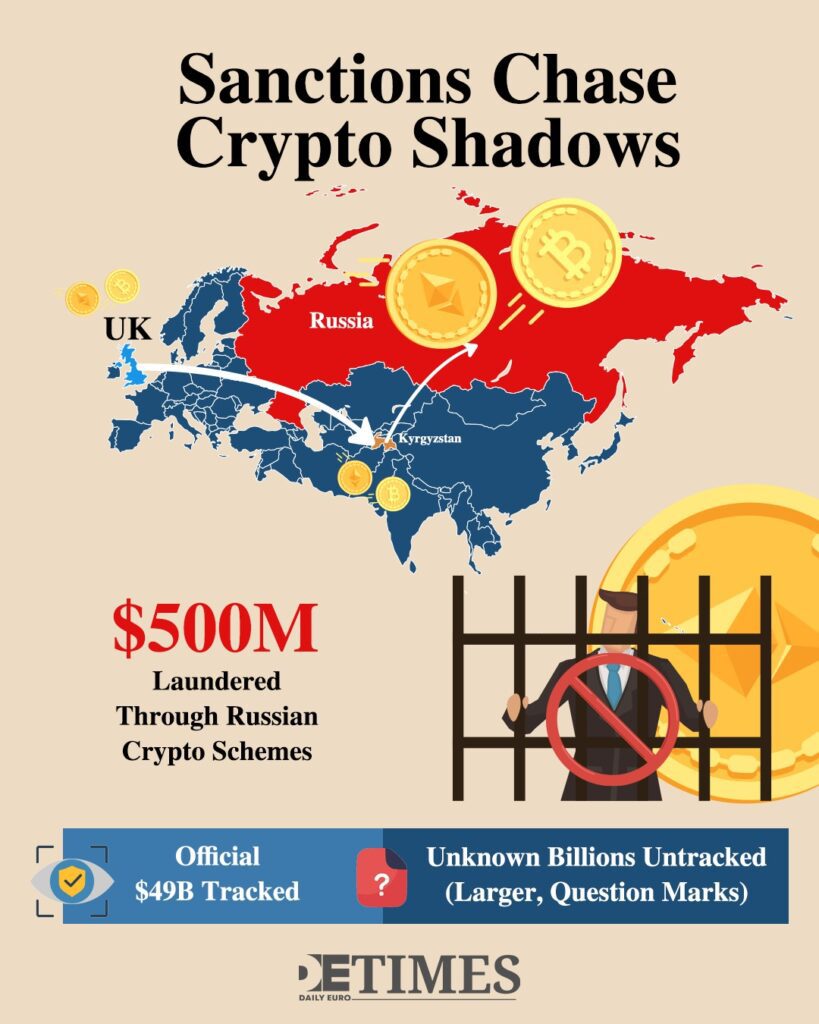

The UK government sanctioned Russian crypto networks three weeks ago, targeting Kyrgyz financial sectors that channel Russian money through opaque networks.

Brussels considers including Russian cryptocurrency exchanges in new EU sanctions packages announced just hours ago.

These latest moves respond to Russia’s rapidly expanding digital payment infrastructure.

Scale of Digital Financial Operations

The Bank of Russia recorded $49 billion worth of international cryptocurrency payments in just one quarter of 2023-2024. This volume occurred before Russia fully legalised cryptocurrency mining and cross-border settlements. A RAND Corporation study confirms Russia increasingly relies on cryptocurrency to sustain international trade and circumvent sanctions.

Russian interest in cryptocurrencies runs deep across multiple platforms. The cryptocurrency app Bybit experienced dramatic growth in Russia during the first quarter of 2024, jumping from 34,800 weekly downloads in January to 88,800 by March.

Search patterns reveal Bitcoin dominates Russian cryptocurrency interest. The digital currency accounts for roughly 62 percent of total search volume. Ethereum follows with nearly 11 percent of queries.

Legal Framework Transforms Underground Activity

These growing crypto volumes prompted Russian authorities to abandon prohibition in favour of regulation. President Vladimir Putin signed legislation legalising cryptocurrency mining from November 1, 2024. The new legal framework introduces two major changes for cross-border commerce.

Mining operations gained full legal status starting November 2024. Additionally, an experimental regime allows authorised companies to conduct cross-border settlements using digital currencies.

Central Bank Governor Elvira Nabiullina had stated the central bank would move money across borders using crypto before the end of 2024. Companies now apply directly to the central bank for approval to participate in active cross-border cryptocurrency settlements.

The experimental regime hands unprecedented power to Russia’s central bank over cryptocurrency operations. All cross-border digital currency transactions require explicit approval from monetary authorities. This centralised control marks a departure from cryptocurrency’s decentralised philosophy yet provides regulatory certainty.

Market Infrastructure Shifts from West to East

Major international exchanges have withdrawn from Russian markets following sanctions pressure. Binance announced its complete exit from Russia in September 2023, selling its entire Russian operation. Local platforms fill the vacuum left by departing international services.

These domestic exchanges operate under direct Russian regulatory oversight and comply fully with sanctions requirements. The infrastructure shift creates a separate cryptocurrency ecosystem where Russian users access different platforms, trade different asset pairs, and follow different regulatory frameworks.

Russia’s cryptocurrency market is projected to reach $1.56 billion in volume by 2025, down 4.83 percent from the previous year but still substantial. This decline masks the shift toward officially sanctioned crypto activity through approved channels.

Geographic Constraints Shape Mining Operations

Russia’s mining legalisation comes with geographic restrictions that reflect broader infrastructure challenges. The government banned cryptocurrency mining in several regions due to electricity shortages just months after authorising the practice nationwide.

Energy-deficient areas cannot support large-scale mining operations while maintaining power for essential services. Mining facilities continue expanding in approved regions where the legal framework provides certainty for businesses willing to invest in substantial infrastructure projects.

The legislation affects both private individuals and industrial operations. Regional mining bans in energy-scarce areas like Dagestan and Chechnya redirect infrastructure investment toward Siberian facilities with abundant hydroelectric power.

Regulatory Fine-Tuning Continues

Recent Central Bank regulations from early 2025 propose banning Tether for domestic use. The Russian Finance Ministry wants to lower barriers to crypto market entry for citizens, signalling ongoing policy shifts.

Authorities continue taking measures to encourage crypto mining businesses to register with tax authorities, including imposing bigger penalties for violations. The Bank of Russia proposed a limited crypto investment pilot for high-net-worth investors in March 2025.

These regulatory adjustments reflect Russia’s attempt to balance financial sovereignty with controlled market development. Wealthy individuals gain access to approved digital assets under strict supervision while mass adoption faces deliberate barriers.

Digital Ruble Development Faces Delays

The digital ruble project faced delays with the first phase now scheduled for September 2026 rather than July 2025. This central bank digital currency will provide another tool for international settlements outside traditional banking systems when finally launched.

Development delays suggest technical challenges in creating a state-controlled digital currency that can compete with decentralised alternatives. The postponement allows more time for Russia’s existing cryptocurrency infrastructure to mature organically.

Western Response Accelerates

Western governments sped up their pushback throughout 2025. Crypto boss Iurii Gugnin faces charges for allegedly washing $500 million through Russian schemes. Going after individual CEOs shows law enforcement means business about crypto sanctions busting.

Britain’s move against Kyrgyz financial networks shows how sanctions enforcers now chase crypto flows across multiple countries. Brussels weighs broader moves against Russian exchanges as Moscow’s legal framework grows.

But enforcement hits walls. That $49 billion quarterly figure only counts officially tracked transactions. Much more money flows through informal networks and peer-to-peer platforms that don’t show up in any government reports.

Britain targeting Kyrgyz crypto networks within weeks of spotting them processing Russian deals, or the $500 million laundering case against crypto CEO Iurii Gugnin, show just how big individual operations get when they’re designed to dodge Western financial restrictions.

Keep up with Daily Euro Times for more updates!

Read also:

Crypto Gamble Chains Milei’s Presidency to the Fence

U.S. Sanctions Derailed as China and Iran Go Full Steam Ahead

Bybit Afloat: Dubai Crypto Firm Survives Despite Historic Hack