In recent years, investment flows from the Gulf countries have increasingly been directed to Europe not only into traditional real estate, but also into high-tech sectors.

The activities of the sovereign wealth funds of Saudi Arabia (Public Investment Fund, PIF) and the United Arab Emirates (ADQ, Mubadala, Abu Dhabi Investment Authority) are particularly noticeable.

Real Estate: Entry Point to “Take Root”

For wealthy families from the UAE and Saudi Arabia, European real estate is not only an asset protected from inflation, but also a strategic resource.

Buying properties in the UK, France, Germany and Spain is considered part of “Plan B“: a place for children, education, business, and in some cases, a second passport.

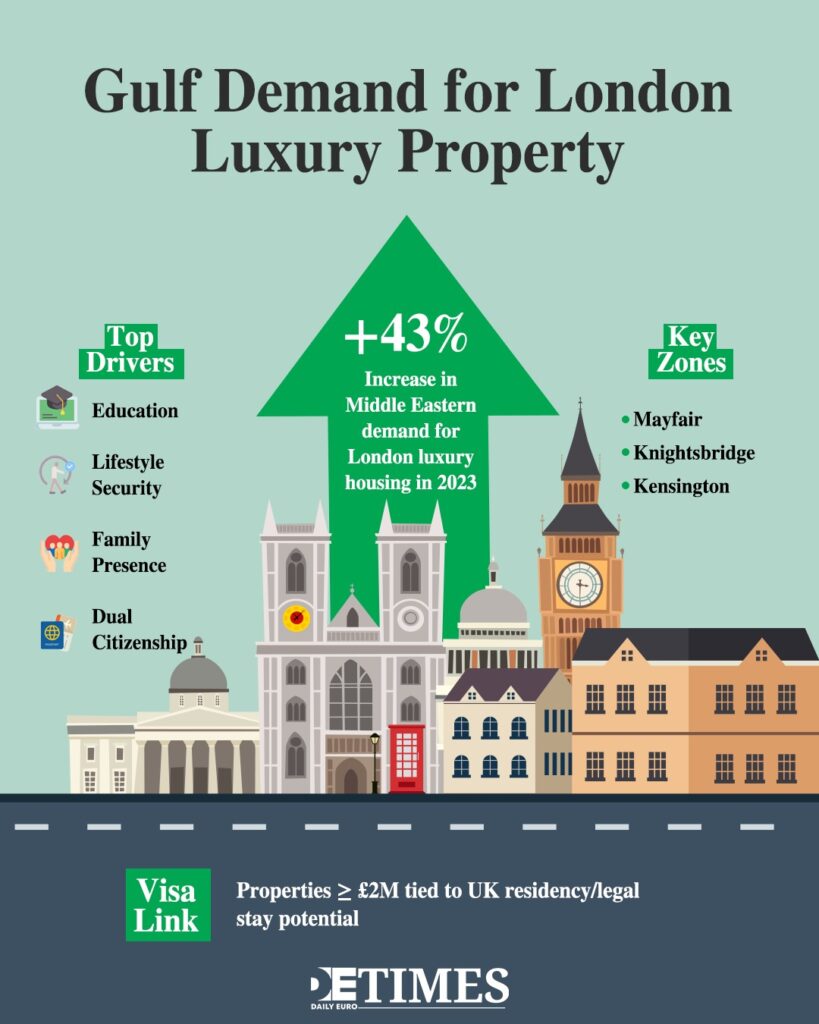

Therefore, the demand for luxury housing in London from Middle Eastern clients increased by +43% in 2023 according to Knight Frank.

Of particular interest are properties with access to prestigious schools, medical centres, and the ability to quickly obtain a residence permit. In some countries, such as Portugal or Greece, this is directly linked to “golden visa” programs.

Tech Shift: Petrodollars to a Startup Ecosystem

While petrodollars used to go to banks and construction, today they are increasingly going to European startups. Sovereign funds are actively investing in FinTech, AI, healthcare, green technologies, and logistics.

Berlin has become a hub for investing in startups in the field of sustainable technologies and mobility; for example, PIF funds have invested in startups working with electric vehicles and urban mobility,

London is also attracting venture capital investments in fintech and medical technology from Emirati state backers: Mubadala and ADQ.

These funds have already invested in companies such as Klarna and Cera. Paris has become an attractive destination for Middle Eastern funds thanks to the rapid growth of technology accelerators and state support from the French government.

Investment Incentives

- Economic Diversification: Both Saudi Arabia and the UAE are seeking to reduce their dependence on oil via Vision 2030.

- Political Insurance: In an unstable region, owning assets in Europe provides legal and physical protection.

- The Next Generation: Families from the UAE and Saudi Arabia want to integrate their children into the international community via British universities, Europe’s business environment, and a Anglophone culture.

Europe is becoming not just an investment destination, but a strategic partner for the Gulf countries.

This is not only capital, but also cultural exchange and the transformation of the cities themselves. For Europe, this is an opportunity to attract resources, create jobs, and strengthen its position in the global economy.

Read the Latest Articles on DET!

Confessions and Invisible Tragedies: Why Cheating is More Popular than Death

A New Wave of Bioethics: The Frontiers of Genetic Engineering

Malta Shuts the Door on ‘Golden Passports’: Contribution, Not Direct Investment