Labour’s 2024 manifesto was straightforward, pledging no increases to National Insurance, VAT, or the various rates of Income Tax.

In a recent pre-budget speech, Chancellor Rachel Reeves prepared the public for “hard choices,” and has since refused to rule out raising income tax.

The government’s message is one of making necessary decisions for the public finances.

The £21 Billion Black Hole

The immediate reason for the reversal is a severe forecast from the Office for Budget Responsibility (OBR).

The OBR is set to downgrade its UK productivity growth forecast by a startling 0.3 percentage points. While it sounds technical, the small change has huge consequences for the UK’s finances.

According to the Institute for Fiscal Studies (IFS), every 0.1 percentage point drop in the productivity forecast adds another £7 billion to government borrowing needs.

Put simply, the OBR’s new forecast opens a fiscal gap of around £21 billion.

The announcement is especially frustrating for the new government, as Treasury officials note that years of overly optimistic OBR forecasts allowed the previous chancellor to deliver tax cuts before the election.

Pointing the Finger at the Past

To explain the reversal, Reeves is blaming past governments. She states that austerity after the financial crisis dealt a “hammer blow” to the economy by gutting public services and investment.

She also cites a rushed and poorly planned Brexit that brought extra costs and paperwork for businesses.

In her own words from Riyadh, Reeves admitted the downgrade originates from “very poor” productivity levels that have plagued the UK since the financial crisis and Brexit.

A Predicament Everyone Saw Coming

The explanation, however, rings hollow for commentators who maintain the government could not have been genuinely surprised.

Paul Johnson of the Institute for Fiscal Studies wrote that the £22 billion fiscal hole was “obvious to anyone who dared to look.”

While the IFS acknowledged that some pressures were harder to see from the outside, it insists that Reeves could not have been unaware of the broader predicament.

Johnson noted that the chancellor cannot honestly blame a hole she just discovered, because the poor state of public finances was evident before the election.

The situation has led to accusations of a calculated political strategy. The Institute for Government even called Labour’s pre-election refusal to acknowledge the fiscal reality its “original sin.”

How the Tax Hikes Might Look

With a sizable budget gap to fill, several tax increases are reportedly on the table.

Economists predict that a 2p rise in the basic rate of income tax is now the “least bad option.” It would cost the average worker on £35,000 a year about £400 in take-home pay.

Another proposal being considered is from the Resolution Foundation, which puts forward a “tax switch.”

The plan would rebalance the system by raising income tax by 2p alongside a cut to national insurance.

The foundation asserts the change would be fairer, as it spreads the tax burden to a wider group that includes pensioners and landlords.

Even as such proposals contradict campaign pledges, Reeves has insisted she will not resign, questioning the chaos it would cause in financial markets.

The Political Crossroads

The budget on 26 November will be a defining juncture that tests the government’s commitment to its stated fiscal rules.

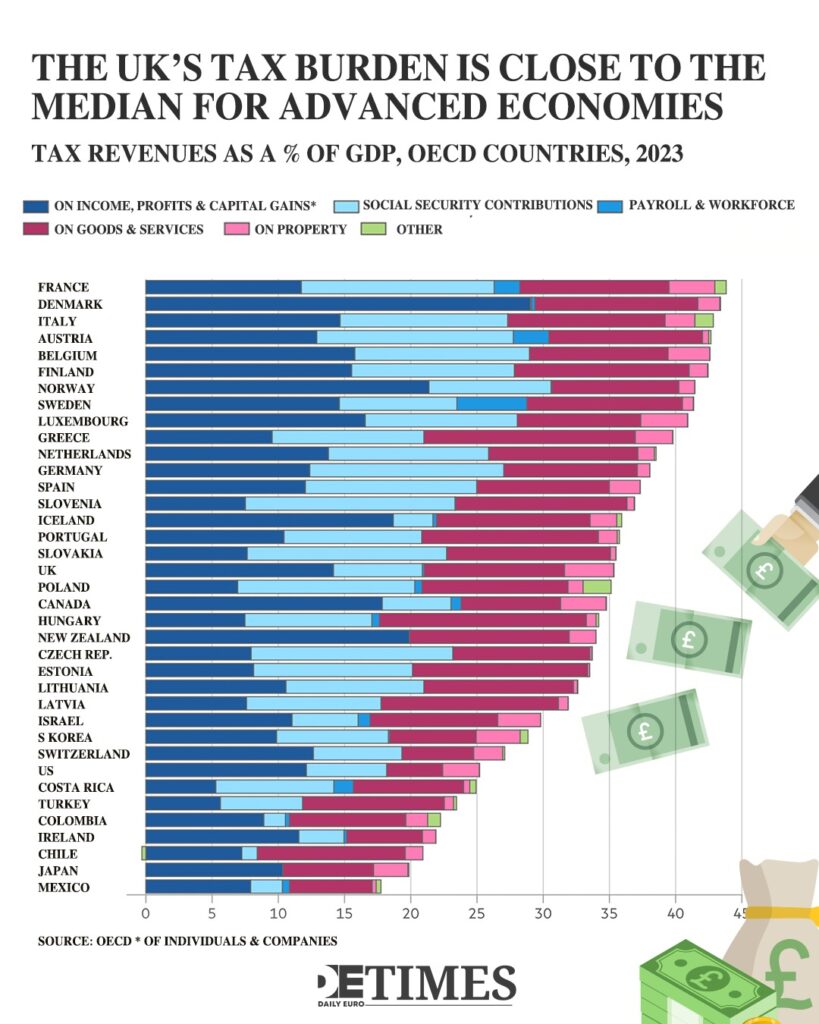

The calculations point to a need to raise around £35 billion a year, pushing the UK’s tax burden to its highest level ever at 38.2 percent of GDP.

The opposition is already seizing on the reversal. Conservative Shadow Chancellor Sir Mel Stride wrote that if the chancellor had truly fixed the public finances as she claimed, “she would not be preparing for more tax rises and broken promises.”

Reeves must navigate a hard course. She appears to have prioritised fiscal credibility, and voters will deliver their own verdict at a future opportunity.

Keep up with Daily Euro Times for more updates!

Read also:

Spring Statement: Saving the UK’s Budget, One Cut at a Time

UK Policy In Review: China’s BYD Overtakes Tesla

Buying Access: How the British Government Rewards the Highest Bidder