The Financial Action Task Force grey-listed the British Virgin Islands on Friday 13 June 2025, exposing gaps in regulation.

The small Caribbean archipelago houses fewer than 40,000 people but maintains company records for almost ten businesses per inhabitant.

Such a ratio defines the island’s model. Financial secrecy serves as the primary export, making reform a direct threat to survival.

The data describes a grim reality. Transparency International research uncovered that BVI companies had been implicated in over 213 cases of grand corruption and money laundering globally. These activities caused hundreds of billions in economic damage.

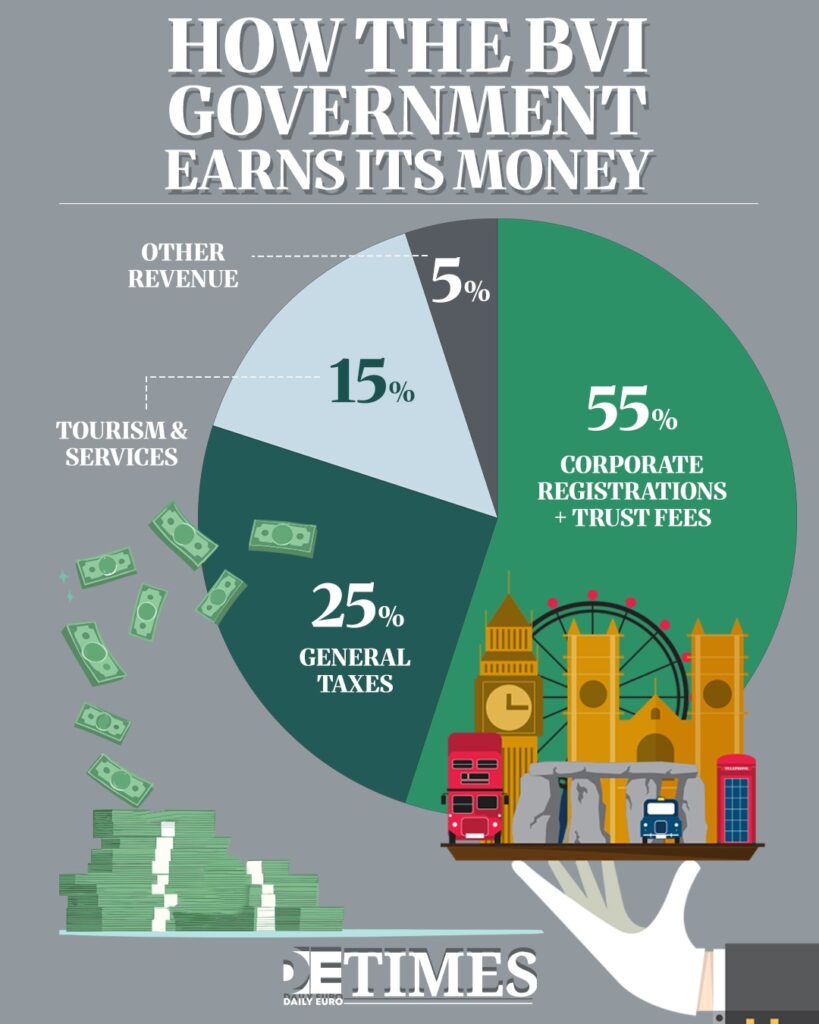

The government earns revenue by facilitating capital flow, while the actual looted wealth settles elsewhere. With over half of government income flowing from trust fees and company registrations, the administration relies entirely on corporate opacity.

The Illusion of Reform

Local authorities balance survival instincts against global demands. Beneficial ownership reporting became mandatory starting January 1, 2025, with an initial deadline in July.

A subsequent postponement pushed the date to January 1, 2026. Every delay proves the administration struggles to abandon its life support.

Proposed reforms rely on calculation. The new Policy on Rights of Access introduces a “legitimate interest” filter. The Act allows beneficial owners to object or appeal before disclosure. Such a notification loop effectively warns targets under investigation.

Transparency International cautioned that the local approach endangers journalists and civil society actors. Warning wealthy targets transforms transparency into theatre.

The territory utilises legal precedents as a shield. Following European Court of Justice rulings in 2022, citing privacy concerns, officials stated that transparency violates data protection rights.

The BVI proposes to release information only on holders of 25 per cent or more of shares. A threshold at that level burdens only unsophisticated actors lacking the means to fragment their holdings.

The Constitutional Standoff

London has reacted with anger. Billions of pounds in suspicious funds were directed into UK property through BVI entities, provoking outrage.

UK MPs Sir Andrew Mitchell and Lloyd Hatton accused the BVI of defying Parliament. They called for the imposition of an Order in Council, utilising Westminster's authority to impose direct rule.

Such a warning carries weight because the UK retains ultimate responsibility for good governance. History provides examples.

The Turks and Caicos Islands were subject to direct rule in 2009 after corruption scandals. Although a new constitution was agreed in 2011 to restore local government, the UK-appointed Governor retained power over financial regulation.

The territory occupies a constitutional zone where local policy relies on British protection. BVI companies leverage the value of British jurisdiction.

With direct intervention looming, the island cannot indefinitely enjoy the privileges of association without the accompanying oversight.

The Hypocrisy of Compromise

Friction between London and Road Town exposes a double standard. Andrew Mitchell MP described the proposal as a shameful evasion and said the BVI proposals displayed contempt for parliament. Great Britain needs strict compliance from the financial networks enriching its own economy.

Addressing the status quo goes through honest economics. The BVI sells secrecy to survive.

Demanding the dismantling of that industry without offering replacement revenue asks a small territory to bear the full cost of global principles.

Unless the international community handles the financial motives driving opacity, we can expect endless bureaucratic exercises.

Keep up with Daily Euro Times for more updates!

Read also:

Europe’s Fragile Outpost: Unrest and Security Challenges in French Guiana

From Wall Street to Hong Kong: The Great Chinese IPO Shift

Buying Access: How the British Government Rewards the Highest Bidder